|

|

|

|

|

|

Welcome to the Australian Ford Forums forum. You are currently viewing our boards as a guest which gives you limited access to view most discussions and inserts advertising. By joining our free community you will have access to post topics, communicate privately with other members, respond to polls, upload content and access many other special features without post based advertising banners. Registration is simple and absolutely free so please, join our community today! If you have any problems with the registration process or your account login, please contact us. Please Note: All new registrations go through a manual approval queue to keep spammers out. This is checked twice each day so there will be a delay before your registration is activated. |

|

|||||||

| The Pub For General Automotive Related Talk |

|

|

Thread Tools | Display Modes |

|

|

#1 | ||

|

FF.Com.Au Hardcore

Join Date: Jan 2010

Posts: 11,325

|

User-chooser business buyers push compact SUVs closer to Australian market dominance

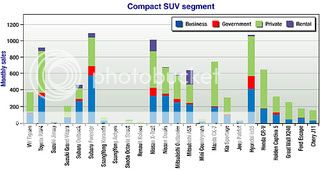

LINK 22 August 2011 By MARTON PETTENDY THE popularity of small SUVs continues to boom in Australia, where compact crossovers keep closing in on small and light-sized passenger cars as the nation’s dominant new-vehicle type. While sales of medium and large SUVs have slumped by 14.5 and 7.8 per cent respectively to July this year, the compact SUV sales surge continued almost unabated (up 2.1 per cent) in a total SUV market that is down 2.9 per cent. In fact, apart from 4x4 utes and luxury passenger cars and SUVs, compact SUV is the only segment to generate sales growth in a total new-vehicle market that has slumped by 5.9 per cent so far in 2011, thanks largely to an 8.0 per cent decline in passenger car sales. This year passenger cars have accounted for 56 per cent of all new vehicles sold (down 1.2 percentage points), while SUVs represented 23.3 per cent (up 0.7), outstripping the 0.6 percentage point share growth of light commercials (18.1 per cent). Having overtaken the declining large car segment (which 4x4 utes have also done this year), the compact SUV sector (67,777 sales to July this year) now lies within 11,250 sales of light cars – Australia’s second most popular vehicle type with 79,026 sales, behind small cars (139,263). Market InsightMarket Insight 2011 center imageLeft: Nissan X-Trail, Hyundai ix35, Toyota RAV4. However, closer inspection of Australia’s love affair with small SUVs shows that most growth in the segment comes from fleet buyers, with rental, government and, in particular, business buyers representing an increasingly large chunk of sales. Just as compact high-riding wagons are increasingly being substituted for traditional passenger cars, so too is the unprecedented growth in ‘user-chooser’ sales blurring the lines between sales to private individuals and buyers of company cars, as more Australians choose to salary-sacrifice and/or undertake novated vehicle leases. Some readers might be surprised to learn that a higher proportion of SUV sales go to fleet buyers than passenger cars, with 57 per cent of all new cars going to private buyers and just 51 per cent of all new SUVs going to non-fleet purchasers, while only 27 per cent of light commercial customers are private individuals (for an overall average of 50 per cent). With only six exceptions, sales of every mainstream compact SUV are down this year, meaning all of the segment’s growth has come from Ford’s evergreen Escape (up 26.3 per cent), Hyundai’s relatively new ix35 (up 91.4 per cent), Kia’s Sportage (up 30.4 per cent), Mitsubishi’s sub-compact ASX (up a massive 945 per cent) and Nissan’s X-Trail (up 41.2 per cent) and Dualis (up 15.2 per cent). Subaru’s Forester has been the country’s top-selling compact SUV since 2008 and, despite a 13.2 per cent sales slide, looks set to claim that title for the fourth consecutive year, but last month it also attracted more ‘business’ buyers than any other compact SUV. More than half of all Forester sales in July went to business buyers, a feat unmatched by any other compact SUV except Subaru’s other small crossover, the Outback. Conversely, Mazda’s CX-7 attracted a higher proportion of private buyers than any other compact SUV last month, when it was the fifth-best-selling vehicle in its class, but so far this year continues to trail the Forester, ix35, RAV4, X-Trail and Dualis. Despite the fact that – at odds with the rest of the Subaru model range, which traditionally attracts a strong mix of private buyers – relatively few private individuals have purchased the Forester this year, the long-running Japanese SUV continues to hold a dominant 11.2 per cent share of the compact SUV segment. Closing the gap is the Hyundai’s fast-selling ix35, which now holds a 10 per cent share of the segment in second place. Once again, however, last month more than 400 ix35s went to businesses from a total of 1063 sales, just 18 sales short of the Forester. Unlike the Forester, which remains one of the few mainstream compact SUVs not to be available in a cut-price front-wheel drive variant, almost half of all ix35 buyers were private individuals, but the ix35 also attracted more than 1500 government sales – more than any other compact SUV. Of course, the success of the three-year-old Forester and the ix35 – launched here in February 2010 – has come at the expense of Toyota’s once-dominant RAV4, the current generation of which dates back to 2006, before a 2WD version was released here in April 2010. Last month the vast majority of RAV4 buyers were private individuals and Toyota’s stalwart compact SUV attracted fewer business and government buyers than either the Forester or ix35. RAV4 sales were down more than 20 per cent in July and remain down 19.5 per cent year-to-date. Having snared just 9.5 per cent of all compact SUV sales so far this year – its lowest share of the segment for some time – the RAV4 is in danger of losing third place to Nissan’s X-Trail, showing just how significant fleet buyers have become in the burgeoning compact SUV class. Market Insight Market Insight 2011 Mr popular: Subaru’s Forester has been the country’s top-selling compact SUV since 2008 and looks set to claim that title for the fourth consecutive year.  Last edited by jpd80; 22-08-2011 at 06:39 PM. |

||

|

|

|