|

|

|

|

|

|

Welcome to the Australian Ford Forums forum. You are currently viewing our boards as a guest which gives you limited access to view most discussions and inserts advertising. By joining our free community you will have access to post topics, communicate privately with other members, respond to polls, upload content and access many other special features without post based advertising banners. Registration is simple and absolutely free so please, join our community today! If you have any problems with the registration process or your account login, please contact us. Please Note: All new registrations go through a manual approval queue to keep spammers out. This is checked twice each day so there will be a delay before your registration is activated. |

|

|||||||

| The Pub For General Automotive Related Talk |

| View Poll Results: How would you finance purchasing a car? | |||

| Purchasing cars using finance and/or other forms of credit is sheer lunacy |

|

22 | 37.93% |

| Using credit to fund new car purchases is the only way to go |

|

11 | 18.97% |

| Shut up and make me a tasty sandwich |

|

25 | 43.10% |

| Voters: 58. You may not vote on this poll | |||

|

|

|

Thread Tools | Display Modes |

|

|

#61 | ||

|

FF.Com.Au Hardcore

Join Date: Sep 2008

Posts: 1,112

|

Thinking about it, whether it's car finance, credit cards, interest free, whatever type of finance there is available and these days there's a lot available - it all comes down to discipline. It's an incredibly useful tool in a lot of different ways.

Credit cards for instance - my partner and I both have one of those AMEX/Visa combo cards hooked up to Qantas frequent flyers. Meanwhile we have an offset account for our mortgage. Every single item we buy goes on those credit cards - drinks at the pub are put on a tab and paid for on credit, every supermarket trip, every litre of fuel, every utility bill - all on credit. Meanwhile every dollar we earn goes straight into the offset account saving us hundreds each month in interest, and we're earning loads of flyer points on the side. A direct debit is set up to pay all the cards off in full on the due date. This setup is actually recommended by the banks. It works really well for us, but unless you're diligent in paying off those cards in full each and every month there is potentially a huge trap there waiting to swallow you up. Can't pay cash means you can't afford it? We pay cash for almost nothing! |

||

|

|

|

| 4 users like this post: |

|

|

#62 | |||

|

Where to next??

Join Date: Oct 2006

Location: Sydney

Posts: 8,893

|

Quote:

Works very well and beats the banks at their own game but you need to be VERY disciplined!

__________________

___________________________ I've been around the world a couple of times or maybe more....... |

|||

|

|

|

| 2 users like this post: |

|

|

#63 | ||

|

Regular Member

Join Date: Feb 2011

Posts: 309

|

I can't believe that so many people have a spare $30k to $60k laying around that they don't need to finance.

I've had many cars (used and new) and they have always been financed in one way or another (eg Personal Loan, Novated Lease, Dealer Finance). I think the key here is no different from any other purchase. As long as you can afford the payments and live within your means, then why not ?

__________________

2015 Renault Megane RS265 - 2L Turbo 6Spd Manual 2022 (21.75) Ford Everest Bi-Turbo |

||

|

|

|

|

|

#64 | ||||

|

Critical Thinker

Join Date: Jan 2005

Location: Adelaide

Posts: 20,378

|

Quote:

Quote:

__________________

"the greatest trick the devil pulled, is convincing the world he doesn't exist" 2022 Mazda CX5 GTSP Turbo 2018 Hyundai Santa Fe Highlander 1967 XR FALCON 500 Cars previously owned: 2021 Subaru Outback Sport 2018 Subaru XV-S 2012 Subaru Forester X 2007 Subaru Liberty GT 2001 AU2 75th Anniversary Futura 2001 Subaru GX wagon 1991 EB XR8 1977 XC Fairmont 1990 EA S Pak 1984 XE S Pak 1982 ZJ Fairlane 1983 XE Fairmont 1989 EA Falcon 1984 Datsun Bluebird Wagon 1975 Honda Civic |

||||

|

|

|

|

|

#65 | |||

|

The 'Stihl' Man

Join Date: Jan 2005

Location: TAS

Posts: 27,585

|

Quote:

We generally score a "free" flight for the family over Christmas based on normal consumption for simply buying stuff I would normally anyway. I dont go out of my way with points promo's though.

__________________

|

|||

|

|

|

| 2 users like this post: |

|

|

#66 | |||

|

Critical Thinker

Join Date: Jan 2005

Location: Adelaide

Posts: 20,378

|

Quote:

__________________

"the greatest trick the devil pulled, is convincing the world he doesn't exist" 2022 Mazda CX5 GTSP Turbo 2018 Hyundai Santa Fe Highlander 1967 XR FALCON 500 Cars previously owned: 2021 Subaru Outback Sport 2018 Subaru XV-S 2012 Subaru Forester X 2007 Subaru Liberty GT 2001 AU2 75th Anniversary Futura 2001 Subaru GX wagon 1991 EB XR8 1977 XC Fairmont 1990 EA S Pak 1984 XE S Pak 1982 ZJ Fairlane 1983 XE Fairmont 1989 EA Falcon 1984 Datsun Bluebird Wagon 1975 Honda Civic |

|||

|

|

|

|

|

#67 | ||

|

FF.Com.Au Hardcore

Join Date: Sep 2008

Posts: 1,112

|

That's why the AMEX/Visa combo cards are the way to go - 2 cards, 1 annual fee. Use the AMEX whenever possible, Visa every other time. It's never worth paying merchant fees for a few extra points.

|

||

|

|

|

| This user likes this post: |

|

|

#68 | |||

|

Where to next??

Join Date: Oct 2006

Location: Sydney

Posts: 8,893

|

Quote:

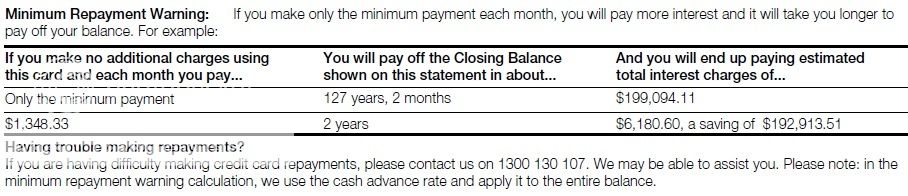

I had a bit of a chuckle when I saw this on the back of one of my CC statements:

__________________

___________________________ I've been around the world a couple of times or maybe more....... |

|||

|

|

|

| 4 users like this post: |

|

|

#69 | ||

|

Critical Thinker

Join Date: Jan 2005

Location: Adelaide

Posts: 20,378

|

I have the AMEX/ Master card combo ;)

__________________

"the greatest trick the devil pulled, is convincing the world he doesn't exist" 2022 Mazda CX5 GTSP Turbo 2018 Hyundai Santa Fe Highlander 1967 XR FALCON 500 Cars previously owned: 2021 Subaru Outback Sport 2018 Subaru XV-S 2012 Subaru Forester X 2007 Subaru Liberty GT 2001 AU2 75th Anniversary Futura 2001 Subaru GX wagon 1991 EB XR8 1977 XC Fairmont 1990 EA S Pak 1984 XE S Pak 1982 ZJ Fairlane 1983 XE Fairmont 1989 EA Falcon 1984 Datsun Bluebird Wagon 1975 Honda Civic |

||

|

|

|

|

|

#70 | |||

|

FF.Com.Au Hardcore

Join Date: May 2010

Posts: 3,338

|

Quote:

The above just makes the whole system a joke. |

|||

|

|

|

|

|

#71 | |||

|

Regular Member

Join Date: Feb 2011

Posts: 309

|

Quote:

Surely there is a level of ownership on the person taking out the loan to use common sense. As an example, if you take out an Interest Free Loan for 36 Months for $5,000...then common sense tells you that you will need to pay $5,000 divided by 36 per Month. It ain't rocket science and yet so many people are amazed at the balloon at the end because they paid the minimum monthly payment. (Yes, I am aware of the Monthly Account Fee and this should also be accounted for by the rocket scientist)

__________________

2015 Renault Megane RS265 - 2L Turbo 6Spd Manual 2022 (21.75) Ford Everest Bi-Turbo |

|||

|

|

|

|

|

#72 | ||

|

Banned

Join Date: Dec 2004

Posts: 8,303

|

I've placed an order for a vehicle, ~$45k driveaway. Unfortunately I can't novate it due to its specifications, but it's the vehicle that suits my needs, and I intend to keep it for a decade.

Two options I've done the sums for have been: 1. $15k straight out of the mortgage (currently 4.95%, no fees), $30k financed over 7 years (5.9%, $5/month fee, ~900ish initial misc setup fee crap) 2. $45k straight out of the mortgage. Over 7 years the overall additional cost of the finance is ~$2500, or ~$350/yr compared to simply taking it all out of the mortgage. Let's round that up & call it $1/day. This is based on sticking to payments over the full 7 years. I haven't committed to either finance option as the vehicle's still a couple of months off, but in my case it looks like the finance option may be the better one. It "gives me an extra $30k" right now by keeping it in my mortgage, for investment or flexibility, or just to get closer to knocking off the mortgage. My job is very stable & I can currently easily pay in excess of my mortgage (& this 7yr loan's) minimum payments. Also my mortgage has a variable rate, & who knows where interest rates will be in 7 years... I'm aware the finance setup fee & $5/month could effectively be re-calculated as an interest rate & it probably turns 5.9% into >7%, but for the initial flexibility over the first year or three, it's worth paying more overall, later. Each to their own really, everybody's situation is different. I bought my first two cars with cash I'd saved up. I could have paid cash for my last car but took out a loan so I had good credit history prior to my mortgage. This left extra $$$ in my savings so I had the 20% deposit needed to avoid mortgage insurance & secure a better deal through the bank. Yes, the car directly cost me more to pay off due to finance, but overall saved me a hell of a lot through the purchase of the property. I used to hate debt & treated it as an enemy. Now I just use it as a leverage tool - provided I keep the upper hand. |

||

|

|

|

| This user likes this post: |

|

|

#73 | |||

|

_Oo===oO_

Join Date: Dec 2004

Location: Australia

Posts: 3,305

|

Quote:

Then I discovered the joys of owning a late model car. However, instead of buying brand new (2010 model) through a dealership and accepting their 'best rate' on finance, I tracked down a 12 month old example (which cost a third less than a brand newie) and got a finance broker to chase down the legit best rate. The loan was on a 5 year term, however I wrapped it up in 24 months. With all said and done, I still didn't pay as much as the (haggled) price on a brand new example (let alone interest on top of that); and in 2013 I had the same 3 year old car as someone who bought new in 2010, but paid much less. I ended up trading that car on a brand newie that I had to have (still got a great interest rate through my broker) but if I 'd kept the original long term (5-7-10 years), it would've been a ripper deal overall. I chose finance because I wanted to keep the funds free. I see the interest (and associated fees) I paid on my purchase as basically paying for the privilege of extra liquidity. As thrifty as I am, I wouldn't change the purchase of the new car (Fiesta ST) for anything. Sometimes, if you really want something you have to accept the terms and charges and factor them into the purchase (I did get a great price on trade in, and a good price on the ST). I can afford the repayments, I'm keeping this baby long term, and I won't meet my maker thinking 'what if'. |

|||

|

|

|

|

|

#74 | |||

|

Where to next??

Join Date: Oct 2006

Location: Sydney

Posts: 8,893

|

Quote:

If Commbank suggest a minimum monthly payment that takes 130 years then they are in the wrong to give a figure that is IMPOSSIBLE to achieve. They need to factor into the calculation that the balance must be paid off within 20 years (or even 15 years) and then work backwards from there. I think they drag it out like that because they are getting their 20% interest and the smaller the minimum figure is the more interest they get.

__________________

___________________________ I've been around the world a couple of times or maybe more....... |

|||

|

|

|

| This user likes this post: |

|

|

#75 | |||

|

FF.Com.Au Hardcore

Join Date: May 2009

Location: Brisbane (Southside)

Posts: 1,171

|

Quote:

You only live once!!!!

__________________

2008 FG XR6 Turbo ZF In Sensation - Gone, but not Forgotten.... Hers: 2024 Ford Everest Platinum in Equinox Bronze His Daily: 2020 (MY21) Kia Sorento GT-Line in Mineral Blue His Weekender: 2017 Commodore SSV Redline manual in Light My Fire Orange |

|||

|

|

|

| This user likes this post: |

|

|

#76 | |||

|

_Oo===oO_

Join Date: Dec 2004

Location: Australia

Posts: 3,305

|

Quote:

|

|||

|

|

|

| This user likes this post: |

|

|

#77 | ||

|

FF.Com.Au Hardcore

Join Date: Jan 2006

Posts: 2,125

|

Depending on how much you are financing and how quickly you can pay it back, you can take advantage of interest free balance transfers.

Such as, Take out credit to buy a car, say $20k (This wont work if you're looking to spend BIG money) then immediately have the amount transferred to the credit card of a bank which is offering interest free balance transfers for 18 months. Pay the car off over 18 months with no interest, if its going to take longer, apply for another interest free balance transfer before that original 18 months interest free period is up. |

||

|

|

|